Relative Strength Index RSI: You Want to Study It For These Buy or Sell Signals

Contents:

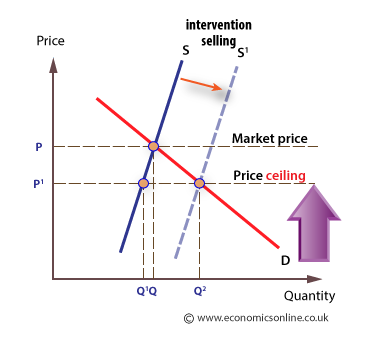

For example, as proposed by Constance Brown in “Technical Analysis for the Trading Professional,” an oversold reading in an uptrend is possibly much higher than 30. Similarly, an overbought reading during a downtrend is much lower than 70. Arrow indicators for binary options are the tools for “the lazy”.

High RSI levels, above 70, generate sell signals and suggest that a security is overbought orovervalued. A reading of 50 denotes a neutral level or balance between bullish and bearish positions. Dynamic momentum index is technical indicator that determines if a security is overbought or oversold and can be used to generate trading signals.

Relative Strength Index (RSI)

Conversely, the RSI bullish divergence will form when the price forms a lower low, and the RSI forms a higher low. This is a warning sign that the trend direction might change from a downtrend to an uptrend. RSI divergence is widely used in Forex technical analysis. Some traders prefer to use higher time-frames for trading RSI divergence. Using these strategies, you can achieve various RSI indicator buy and sell signals. The Relative Strength Index is a technical indicator primarily used in the financial markets.

This negative reversal foreshadowed the big support break in late June and sharp decline. Like many momentum oscillators, overbought and oversold readings for RSI work best when prices move sideways within a range. Chart 4 shows MEMC Electronics trading between 13.5 and 21 from April to September 2009. The stock peaked soon after RSI reached 70 and bottomed soon after the stock reached 30. Trend signals that indicate a reversal are called failure swings. These swings can take place during uptrends and downtrends, where the former indicates selling activity while the latter represents buying activity.

The Best Forex Demo Accounts

When the https://1investing.in/ reading is between 70 and 100, the security is supposed to be heavily bought and is ready for a downward correction. The first step is to calculate ‘RS’ also called the RSI factor. As you can see in the formula, RS is the ratio of average points gained by the average points lost. What this means is that essentially Divergence should be used as a way to confirm trends and not necessarily anticipate reversals.

- Investopedia requires writers to use primary sources to support their work.

- Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences.

- Assuming a 14-period RSI, a zero RSI value means prices moved lower all 14 periods and there were no gains to measure.

In bull markets, he found that the RSI tends to oscillate between 40 and 90, with becoming support levels. And for the bear markets, he instead discovered that the RSI tends to oscillate between 10 and 60. Failure swings could be said to be a more advanced version of RSI divergences, where we add additional criteria to complement the divergence. As we touched on before, divergences signal that a change in the trend is coming, but is less suited to point out the exact turning point. RSI ResistanceMost often we look at the price in search of these levels, but we could also attempt to use the RSI. We look for levels that have been reached and defended one or preferably several times.

Moving Averages: How to Use EMA Indicator Guide

The RSI will increase if the number of positive closes increases and if the magnitude of those closes increases. Choose a predetermined period “X” (Standard value is “14”, although a value of “8” or “9” tends to be more sensitive. Familiar with instruments, but don’t know what to trade? Check out some of our commodity guides on precious metals, energy commodities, and agricultural commodities. The break of trendline of the e-mini future was also confirmed by the trendline break of the Relative Strength Index, suggesting that the price move may likely be over.

Dogecoin (DOGE) Price Prediction: What to Expect in the Next 48 … – Investing.com

Dogecoin (DOGE) Price Prediction: What to Expect in the Next 48 ….

Posted: Thu, 06 Apr 2023 08:00:00 GMT [source]

One thing to keep in mind about failure swings is that they are completely independent of price and rely solely on RSI. Failure swings consist of four “steps” and are considered to be either Bullish or Bearish . RSI Divergence occurs when there is a difference between what the price action is indicating and what RSI is indicating. These differences can be interpreted as an impending reversal. Specifically there are two types of divergences, bearish and bullish.

Once calculated, the RSI is displayed as an oscillator, which is a line graph between two extreme values. As with any technical indicator, an RSI chart will never be 100% correct. False signals can occur, but the positive signals are consistent enough to give a forex trader an edge. For example, it rarely falls below 40 in the case of a stock that is in a strong uptrend, and usually moves between 40 and 80 levels. This type of situation can be seen in the HCL Tech chart.

Every type of trading strategy will have its winners and losers. In that regard, seeing some trades just turn red with the falling market is completely normal. Down days are defined as days closing lower than the previous day’s close. The RSI indicator is one of the most popular and well-known trading indicators out there.

The stock ultimately bottomed around 46 a few weeks later ; the final bottom did not coincide with the initial oversold reading. Welles Wilder, the Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. According to Wilder, RSI is considered overbought when above 70 and oversold when below 30. Signals can also be generated by looking for divergences, failure swings and centerline crossovers. As a momentum indicator, the relative strength index compares a security’s strength on days when prices go up to its strength on days when prices go down. Relating the result of this comparison to price action can give traders an idea of how a security may perform.

Cardano price analysis: ADA slips to $0.3894 as market downtrend … – Cryptopolitan

Cardano price analysis: ADA slips to $0.3894 as market downtrend ….

Posted: Sun, 09 Apr 2023 13:09:52 GMT [source]

This work featured the debut of his new momentum oscillator, the Relative Strength Index, better known as RSI. The RSI tends to remain more static during uptrends than it does during downtrends. This makes sense because the RSI measures gains versus losses.

That means types of insurance: different types of insurance policies in india the oversold threshold lower and the overbought threshold higher. If the RSI value is fixed in a region for a prolonged period, it indicates excess momentum. Hence, instead of taking a reversed position, the trader can consider initiating a trade in the same direction.

Positive and negative reversals is another trading approach offered by Cardwell. He noted that the rule of direct divergence is not often observed. For example, a positive reversal occurs when the next low is higher than the low of the previous price correction down in the uptrend. The indicator line is most of the time between levels 40 and 80. Both signals at the moment of touching level 40 are strong and true. Note that you should not consider the price rebound from level 80 as a signal to enter a trade in the uptrend.

That means that it’s priced above where it should be, according to practitioners of either technical analysis or fundamental analysis. Traders who see indications that a security is overbought may expect a price correction or trend reversal. The relative strength index is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. Because it measures the speed and size of an asset’s momentum, changes in the RSI along with changes in the price chart can be a powerful indicator of trend reversals.

- First, stocks must be above their 200-day moving average to be in an overall uptrend.

- In other words, we need to have two higher highs in the price chart, coupled with two lower highs in the RSI.

- Determines what data from each bar will be used in calculations.

- The thin red ovals mark the reference points of the indicator coinciding with level 30.

- The slope of the RSI is directly proportional to the velocity of a change in the trend.

It is an oscillator that indicates the trend strength and the chance of the trend reversal. RSI measures the speed and change in the price movement. The stronger is the market price movement up or down, the closer is the indicator line to the extreme levels of 100 or 0. The oscillator defines the RSI overbought and oversold area where the trend is most likely to reverse.